CDFI Statute and History

Program Origins

On November 21, 1992, Cliff Rosenthal of the National Federation of Community Development Credit Unions and Martin Paul Trimble of the then-named National Association of Community Development Loan Funds (now OFN) convened a meeting in Washington, DC to form The CDFI Coalition.

Starting from a paper Rosenthal had written in the mid-1980s proposing a National Community Bank modeled on the National Coop Bank and a concept paper Trimble wrote at the request of the John D. and Catherine T. MacArthur Foundation, that founding group produced Principles of Community Development Lending & Proposal for Key Federal Support.

The new Coalition group then worked diligently to get the paper into the hands of President-elect Clinton’s team. Shortly after assuming office in 1993, President Bill Clinton proposed legislation to provide federal support for community development financial institutions serving customers in low income communities.

Working closely with the Clinton Administration, the CDFI Coalition helped shape the final legislation to ensure that it would help build the CDFI industry and encourage banks and other conventional lenders to step up their work in under-served communities.

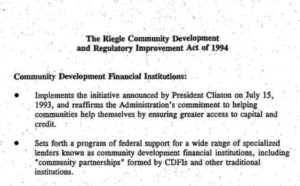

The Riegle Community Development Banking and Financial Institutions Act of 1994 received broad bipartisan support in both houses of Congress, and was signed into law on September 24, 1994 by President Clinton.

For a comprehensive history of the program’s budget and Congressional approved funding over the years, please click here.

Read 1994 Riegle Community & Regulatory Improvement Act

CDFI Mission & Governance

The central purpose of The Community Development Banking and Financial Institutions Act of 1994 (the CDFI Act) was to create a CDFI Fund to promote economic revitalization and community development by investing in and assisting CDFIs through equity investments, capital grants, loans and technical assistance support. CDFIs can use this financial assistance to support an array of community development activities including housing for low-income people, businesses owned by low-income people, basic financial services, commercial facilities that promote job creation or retention, and technical assistance. The Fund seeks to build the capacity of the individual institutions it finances to bolster their ability to start, expand and improve their programs, thus strengthening and expanding the national network of CDFIs.

The Fund is housed in the U.S. Treasury Department. A 15-member advisory board is comprised of six government representatives: the Secretaries of Agriculture, Commerce, HUD, Interior, and Treasury as well as the SBA Administrator; and nine private citizens: two CDFI representatives, two representatives from insured depositories, two national public interest representatives, two community development specialists, and one Native American community development representative.

CDFIs : Then & Now

1993: Announcement of the Community Banking Act

1994: Riegle Act Bill - President Clinton Bill Signing

2014: President Obama Visits CDFI Financed Community College & Training Center