About CDFIs

CDFIs are private-sector organizations that attract capital from private and public sources. Private sector funds come from many sources: corporations, individuals, religious institutions, and private foundations.

Depository CDFIs, like community development banks and community development credit unions, get capital from customers and non-member depositors. CDFIs work in partnership with conventional financial institutions to channel private investment into distressed communities, either through direct investment in the CDFI or through coordination of lending, investment, and other services.

One crucial source of support for CDFIs is the federal CDFI Fund, administered by the Department of the Treasury. The CDFI Fund makes capital grants, equity investments, and awards to fund technical assistance and organizational capacity-building. CDFIs apply for limited funds through a competitive process that requires the CDFI, in most cases, to provide at least a 1:1 match of non-federal funds to receive financial assistance.

The Fund also rewards banks and thrifts for making investments in CDFIs and distressed communities through its Bank Enterprise Award Program. The New Markets Tax Credits Program, initiated in 2002, encourages private sector investment by offering tax credits for qualified community development investments. CDFIs use the money awarded through CDFI Fund programs to leverage private-sector resources into distressed communities.

CDFIs differ from mainstream financial institutions in some key aspects. For example, many CDFIs offer non-conforming mortgages or loans. Others make accounts available to customers with limited or poor credit history. Mainstream institutions, on the other hand, tend to offer a few generic programs designed to capture the broader market.

CDFIs cultivate specialized knowledge about the communities in which they do business. They forge deep relationships with their customers and community leaders. This translates into a willingness and commitment to spending time on individualized service, and specialized programs that are often too time-consuming or costly for mainstream financial institutions to implement.

Despite these differences, CDFIs do not supplant conventional financial institutions. In fact, they complement each other. Because CDFIs and banks share a market-based approach to serving communities, CDFIs often work in partnership with banks to develop innovative ways to deliver loans, investments, and financial services to distressed communities. Oftentimes, they jointly fund community projects, with the CDFI assuming the more risky subordinated debt.

Mainstream financial institutions also invest their own capital directly in CDFIs, receiving Community Reinvestment Act (CRA) credit and potential cash rewards under the CDFI Fund’s Bank Enterprise Award Program. Furthermore, CDFIs create a future market for mainstream financial institution products and services. They incubate businesses and people, helping them to grow and prosper. Once their customers have achieved some success, established a good credit history and have reached a substantial size, they can “graduate on” to borrowing larger amounts available from more conventional lending institutions.

CDFIs are trailblazers in their communities, leading the way in investing in distressed urban and rural neighborhoods and bringing people into the economic mainstream as contributors to the economy.

While the term “community development financial institutions” or “CDFI” is relatively new, the concept itself is part of a rich history of self-help credit.

From the immigrant guilds of New York City’s Lower East Side and the Prairie Populists of the late 1800s, to African-American communities forming the first community development credit unions in the 1930s, communities have sought self-help credit solutions because traditional financial institutions have ignored or abandoned them.

The current CDFI industry began taking shape in the late 1960s and early 1970s. Some of the first organizations dedicated to community development were created out of governmental efforts to address poverty alleviation and racial discrimination. The Johnson Administration, under its “War on Poverty” campaign and through the Office of Economic Opportunity, launched community development corporations (CDCs) to work in both urban and rural poor communities. In the successes of many of these early CDCs lay the foundation for today’s CDFI industry.

In the 1970s, CDFIs expanded their funding sources by reaching out to private organizations, particularly religious institutions and individuals. Many business-development loan funds were launched with federal funds from the Department of Housing and Urban Development, the Economic Development Administration and the Department of Agriculture. Community development credit unions and banks were started in the 1970s, such as South Shore Bank in Chicago (1973) and the Santa Cruz Community Credit Union (1977). The Neighborhood Reinvestment Corporation (NRC), a national intermediary that supports local Neighborhood Housing Services offices, was created in 1973 and began financing affordable housing in 1978. In April 2005, Neighborhood Reinvestment Corporation began doing business as Neighborworks® America.

Despite the increased diversity of funding sources, CDFIs grew only incrementally through the 1970s and 1980s. It wasn’t until the 1990s that the CDFI industry expanded dramatically.

The Riegle Community Development Banking and Financial Institutions Act of 1994 received broad bipartisan support in both houses of Congress, and was signed into law on September 24, 1994 by President Clinton. Furthermore, Community Reinvestment Act (CRA) regulations in 1995 explicitly recognize loans and investments in CDFIs as a qualified CRA activity.

Please read the comprehensive history of the program’s establishment and overview of Congressional funding throughout the years. Additionally, For an in-depth history of the movement to establish the CDFI industry and the CDFI Coalition, Clifford Rosenthal has published a book in 2018 by FriesenPress.

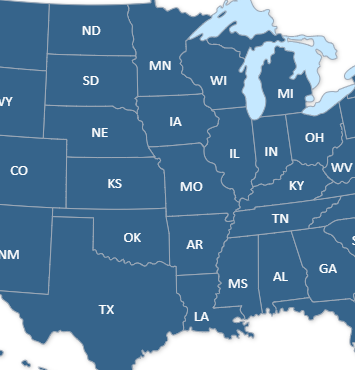

Since the program’s establishment, it has a continual and growing record of success and bipartisan support that has inspired confidence in the CDFI industry and attracted new sources of support and funding. As of Spring 2021, the number of CDFIs continues to increase. There are over 1,160 certified CDFIs, with a great diversity of missions. CDFIs operate in every state and the District of Columbia, serving both rural and urban communities.

For a comprehensive comparison of CDFI Types, please click here.