Built to Scale: Designing a Business with Scale in Mind

Empowered Women International is a program under the Latino Economic Development Center that unlocks the potential of women through the power of entrepreneurship.

St. John Manor

Clearinghouse CDFI (CCDFI) provided a $4,097,478 loan to St. John Village, LP to support the refinancing efforts of St. John Manor, an affordable independent living property for senior citizens in Bakersfield, CA.

Catonsville CO-OP brings together food, community, and local businesses

In the summer of 2011, a few Catonsville residents met at the local library. They shared a passion for supporting local businesses and wanted to bring those products into their community. Eleven years later, that idea has blossomed into the Catonsville Cooperative (CO-OP) Market and Grocery, a market and community hub owned and operated by…

A Grand Opening Like No Other

A brand new, 90-unit affordable housing community near downtown Sunnyvale, has opened the doors to its first residents and officially celebrated with a Grand Opening like no other!

Bridging the Gap: A Public Servant’s Path to Homeownership

For years, Kathleen dreamed of owning a home where she could build stability and one day welcome a foster child.

EPIC Federal Credit Union breaks ground on Covington Branch

EPIC CEO Shelley Sanders is excited to bring the EPIC Experience to the Northshore, “In addition to checking, savings and great lending rates, this new branch will feature mortgage and lending experts as well as state-of-the-art electronic banking services so now Northshore residents can access a truly EPIC financial experience.”

INHP breaks ground on its first affordable home in City of Southport

The Indianapolis Neighborhood Housing Partnership (INHP), in partnership with the City of Southport and with support from the Indiana Housing and Community Development Authority (IHCDA), is today breaking ground on a new affordable home at 10 Church St. in Southport, Ind.

Sew What

Sew What is an upholstery and sewing business in Churubusco, Indiana. Angela Enright, owner-operator, serves local walk-in appointments as well as private and commercial projects for national accounts. Their services range from furniture recovery to vehicle and boat products.

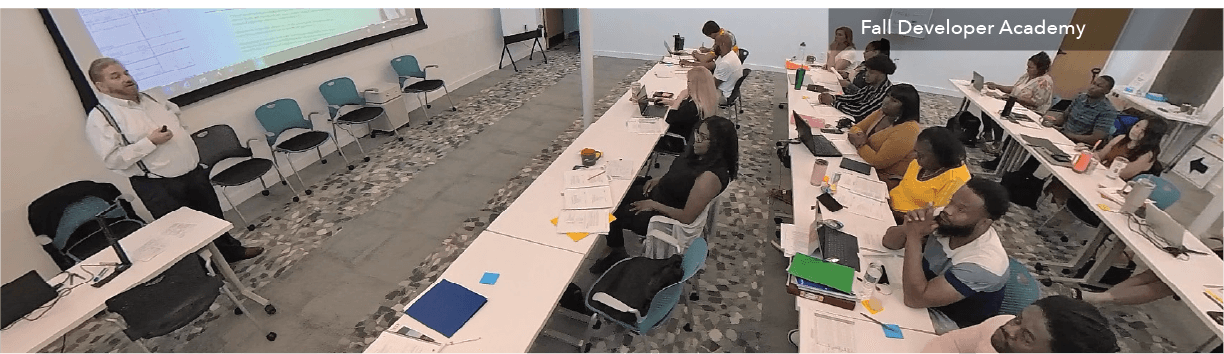

12 Graduate from St. Cloud Enterprise Academy

The Initiative Foundation is celebrating the graduation of 12 entrepreneurs who are dedicated to building their homegrown business ideas in the St. Cloud area.

Viva Long Prairie

Opening Viva meant overcoming big hurdles—including financing a major renovation of a century-old building. But Perez stayed true to his approach, chasing solutions until he secured a state revitalization grant and loan support from the Initiative Foundation.

Eagles Healing Nest

Aaron Starrett was 18 years old in 2009 when he left his hometown of Austin, Texas, for four years in the Air Force. He served as a munitions specialist in Korea and Germany, helping prepare aircraft with heavy explosives before leaving the military in 2014.

Braiding Business and Belief

Timely loan weaves a solution to keep St. Cloud salon owner’s business buzzing

Three Roots Capital Provides Financing for Protomet Expansion in Roane County

Three Roots Capital partnered with Regions Bank to help finance Protomet Corporation’s new manufacturing facility in Rockwood, Tennessee. This $25 million expansion will create 250 new jobs and retain 150 existing positions.

Preserving affordable housing in the Park Avenue neighborhood

Spark Capital invested funds to help inCOMMON acquire this 5-unit complex in the Park Avenue neighborhood, preserving affordability for neighbors. The property, located at 1612 S. 32nd Avenue, Omaha, NE 68105, is a residential multi-family property consisting of a 2-story building with a finished basement

OFN Story: CDFI Nourishes Hawaii’s Future with Funding for Healthy Food and Agriculture

Native Hawaiian-owned business distributing healthy foods and creating jobs in local community

OFN Story: Recovery Center Transforms Local Community, Economy, and Lives

Financed Kentucky’s largest addiction treatment and vocational rehabilitation center serving 2,500+ individuals and creating 300+ jobs

OFN Story: Puerto Rican School, Backed By CDFI Support, Changes Lives Through Hands-On Education

Created 46 seats in a dual-language Montessori school, in a community where more than half of residents face poverty

Chicago Events Planner Achieves Long-Time Dream With Help From LISC

Ardul Aquino founded Tu Party Chicago in 2012 to make events at any price point possible, starting small by renting tables, chairs and tents for parties and events. Aquino dreamed of purchasing a location to offer to clients to host their events and better serve his clientele. With support from Wells Fargo’s Open for Business…

Philly Builds Credit: A Financial Wellness Initiative

New initiative brings national credit-building model to Philadelphia to turn barriers into bridges

CDFI Credit Unions Lower Interest Rates on Car Loans

Credit Union’s auto loan refinancing program, which slashes interest rates in half. On average, One Detroit is able to reduce members’ monthly payments by $54.16, and sometimes by more than $100, saving them more than $3,000 over the term of their loans.

BEARS, BOATS, AND BUSINESS DREAMS

Native Entrepreneur Brings Tlingit Traditions to Tourism with Spruce Root’s Help

Native CDFIs Fuel Small Business Success Across Indian Country

From Food Truck to Brick-and-Mortar Success

Native CDFIs Fuel Small Business Success Across Indian Country

Business Growth and Expansion

Native CDFIs Fuel Small Business Success Across Indian Country

Always a good day on the sea

Pacific Northwest Tribal Lending Helps Fisherman Live His Big Dream

Greater Green Bay Community Foundation launches Impact Investing Fund

Housing investment initiates a cycle of returns for continuous impact

Bay Bank

Bay Bank Celebrates 30 Years of Commitment and Community Local, Native-Owned Financial Institution Marks Milestone Anniversary

Overcoming Natural Disasters

Julie Painter, a member of the Eastern Band of Cherokee Indians and owner of Visage Salon, faced one of her biggest challenges yet when Hurricane Helene devastated western North Carolina.

Kinser Flats

First Investment from CDFI Friendly Bloomington Provides Affordable Housing and Support Services

The Right Tools and Support Make Ownership Possible for Residents of Mobile Home Communities

Fifteen years ago, Genesis introduced a transformative model to Maine aimed at empowering mobile home park residents…

Ruben Zavaleta’s Journey and the Growth of Guerrero Maya Restaurant

Ruben Zavaleta’s journey from a small town between Mexico City and Acapulco to becoming a successful restaurateur in Maine is a testament to his dedication, vision, and entrepreneurial spirit.

CDFI Program Financial Assistance Success Stories: Spring Bank

A CDFI program in NYC enabling low-income employees to access affordable credit, improve credit scores, and build savings

Healthy Acadia

Keeping People Safe and Warm

White Sails Inn

“Working with SMFA was an absolute pleasure, and I can confidently say that without their support, I’m not sure I would have secured the final amount of money needed for my venture. ”

All Smiles Dental

In Biddeford, Maine, a young dentist’s determination to own his practice has become a reality, demonstrating the significant impact of local support and dedicated learning.

Spurling Fitness

A Journey of Growth and Community Impact

Harvesting Tradition

How Four Directions Development Corporation Helped Mi’kmaq Nation Expand a Fishery into an Enterprise

Bangor mobile home park residents get loan to develop 28 empty lots

The loan comes after the residents raised $8 million to beat out a corporate investor and buy their own mobile home park.

CDFI Program Financial Assistance Success Stories: LiftFund

Helped Guillermo Vasquez launch a stable business in Brownsville, TX, enabling him to send his daughter to college.

HealthWorks

The project involves the rehabilitation and redevelopment of a 31,204 square-foot office building to serve as a healthcare facility in Cheyenne, Wyoming.

Marshall White Center

This investment will finance the new construction of a 68,000 square foot community recreation center in Ogden, UT. The new, significantly larger facility—nearly twice the size of the original—will expand its offerings to better serve the surrounding severely distressed neighborhood.

Rivertree Academy

The construction of a new elementary school in Lake Como neighborhood of Fort Worth, Texas, allowing the sponsor to double its current capacity and increase enrollment from 100 to 270 students each year.

TreisD

TreisD, headquartered in Knoxville, develops advanced 3D image capture, display, and printing technology that delivers solutions across multiple applications, including supply chain security and brand protection. Three Roots Capital provided a loan to the company in June 2025, followed by an equity investment in July 2025. In addition to its headquarters, TreisD is establishing production…

Shift Thermal

Shift Thermal, based in Oak Ridge, is the developer of FLEX™ technology, an advanced thermal storage system designed to reduce energy consumption. The company originated as part of the Innovation Crossroads program at Oak Ridge National Laboratory (ORNL). The TennesSeed Fund first invested in Shift Thermal in 2019 during its start-up phase, and Three Roots…

SmartRIA

SmartRIA, based in Knoxville, provides a leading software platform that helps Registered Investment Advisors (RIAs) and their consultants efficiently manage compliance programs. The TennesSeed Fund first invested in the company in 2019 when it was an early-stage start-up. Since then, Three Roots Capital has made several follow-on investments in SmartRIA, most recently in January 2025.

Zipit

Three Roots Capital congratulates Zipit Wireless, a leader in IoT (Internet of Things) connectivity solutions based in Greenville, South Carolina, on its recent acquisition by Wireless Logic. Zipit’s journey from start-up to early-stage innovator to global player in the IoT market reflects our region’s vision, tenacity, and entrepreneurial spirit. While 3Roots has not provided direct…

YouthBuild Newark (YBN)

Redevelopment of a two-story 31,237 SF commercial building, including the construction of 15 to 17 classrooms, 28 staff offices, and 14 administrative office, in addition to a warming kitchen, café, and student lounges.

Raleigh Rescue Mission

Raleigh Rescue Mission will build an 88,000 SF situational homeless recovery facility, an 18,500 SF children’s learning center, and open green spaces.

Nourish Up

Proceeds will fit out a 19,000 SF commericial kitchen for medically tailored meal production within a 90,000 SF food distribution facility, both of which address food insecurity for low-income people in Charlotte, NC.

Indianapolis Neighborhood Housing Partnership, Inc

The development will feature affordable housing consistent with the 25th and Monon Vision Plan.

Project H.O.O.D

Construction of the Robert R. McCormick Leadership and Economic Opportunity Center, an 88,000 SF multi-use facility in a deeply distressed neigborhood that consolidates multiple much-needed resources into one state-of-the-art facility that residents can use as a one-stop shop for their needs.

Harry Chapin Food Bank

HCFB will construct an approximately 97,000 SF warehouse and distribution center which will replace its current 54,390 SF facility to expand access to healthy foods, nutrition education, and wraparound services and build community resilience.

Food Bank of the Rockies

Additional working capital for the Food Bank.

Rio Grande Hospital

Rio Grande Hospital (RGH) is a nonprofit healthcare organization serving the Western San Luis Valley. RGH operates a hospital in Del Norte, as well as three other healthcare clinics in Creede, Monte Vista, and South Fork. Based on a recent community health needs assessment, RGH determined they needed to create a community wellness facility. The…

Fairchild Medical Center

Fairchild Medical Center (FMC) is expanding its campus to address the critical healthcare shortages affecting low-income, rural residents of Siskiyou County, California. With 30% of residents unable to access care due to a lack of available doctors and 54% unable to secure medical appointments in the past year, the need for increased medical services is…

Better Housing Coalition – (projected)

Supporting the construction of 20 homes as part of Highland Grove project.

Cristo Rey Fort Worth STEAM Center

The school is endeavoring on a multi-phase rehabilitation project aimed at expanding its facilities to better serve its students and staff and create long-term financial sustainability.

Affordable Homes of South Texas, Inc.

With an $8M NMTC allocation, Affordable Homes of South Texas, Inc. (AHSTI) will construct approximately 50 new single-family homes in 5 different subdivisions in Hidalgo County.

Blank Beauty

Blank Beauty is a fast-growing beauty-tech company based in Knoxville that combines science, software, and robotics to create personalized cosmetics. The company recently closed a $6 million Series A funding round to expand its headquarters and production facility in downtown Knoxville. Three Roots Capital invested in Blank Beauty in May 2025, joining a group of…

ATS Innovations

ATS Innovations is the creator of the MetaFlex® Glove, which combines compression and grip-strengthening technology to optimize hand health and performance. Founded by a former Y-12 Plant engineer, the company is woman-owned and innovation-driven. Three Roots Capital invested in the Cookeville-based company in March 2025 and provided a follow-on loan in May 2025

Entrac Medical

Entac Medical is a digital health company based in Memphis, developing wearable devices that use acoustic signals and predictive analytics to detect adverse conditions in patients. The company is built on technology licensed from the University of Tennessee. Three Roots Capital has supported Entac with multiple investments, most recently in February 2025.

Crossroad Health Center

The site acquisition, construction/rehab and equipping of an outdated recreational center into a new 21,000 sq. ft. building for Crossroad Health Center (a FQHC) to expand integrated healthcare, food security, housing placement/referrals and other supportive services, as well as a pharmacy, to 6.5K people/year.

BOLD Charter School

Construction of a 60,000 square feet charter school facility featuring 27 classrooms, small breakout rooms, an art room, music room, science labs, cafeteria/gymnasium, and administrative spaces.

Early Education Center

Construction of 19.8K SF early childhood education center, serving over 200 infant/toddler/pre-k (increase of 134), and 316 fmailies (increase of 56)

Boys and Girls Club of Greater Lowell

Believe & Become is an ambitious campaign to renovate and expand the Boys & Girls Club of Greater Lowell.

Esperanza Academy

This transaction supports the development of a new 31,500 SF school to improve education access for low-income girls.

There’s Love in this Community

Meet one of CHWC’s customers. A single mother, bus driver,…

The Montanez Family

Through Tenfold’s matched savings and financial coaching, Joel and Katelyn achieved their goal of homeownership in Ephrata.

The Tirado Family

Tenfold supported the Tirado family in purchasing their first home in Lancaster City through down-payment assistance and homebuyer education.

Warrior Grocery

Local grocery/deli serving reservation, buying from local ranchers, opening March 2022.

Warrior Meat Company

Mobile meat processing unit onsite at ranchers, finishing beef at facility in Ashland.

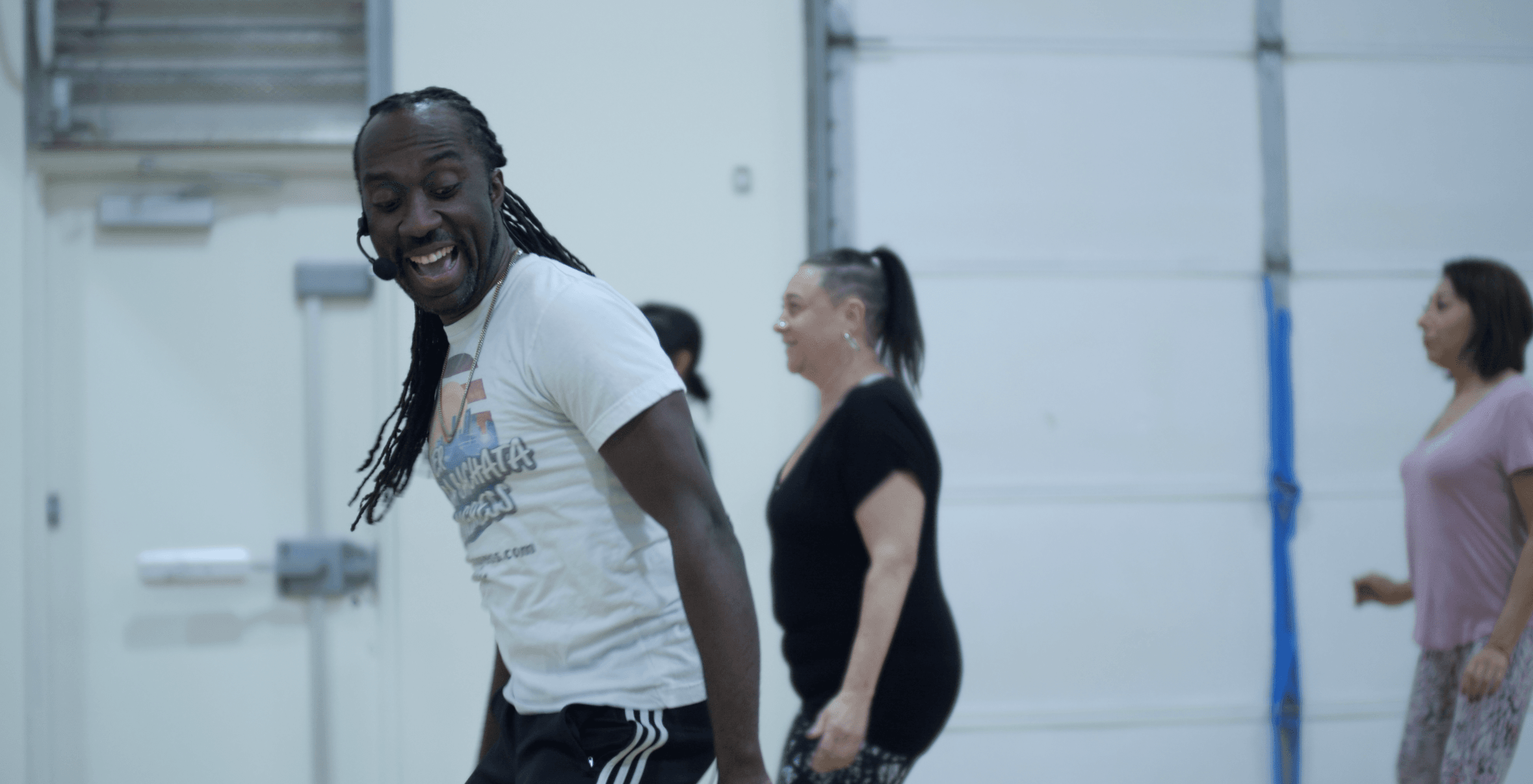

Transformative Culture Project (TCP)

Nonprofit using creative arts for economic development and community engagement.

Thrive Yoga

B:Side Fund supported financing for this rural wellness studio to expand classes and facility services.

Western Rise

B:Side Fund financed inventory purchase via Main Street loan to help this apparel brand grow in Colorado.

White Hat Services LLC

B:Side Fund enabled working capital that helped this IT services firm serve new clients and grow team.

Wilderness Exchange Unlimited

B:Side Fund supported a Great Western Bank loan to this eco-tourism outfitter for fleet and gear expansion.

Ziggi’s Coffee

B:Side Fund helped High Plains Bank finance this coffee chain’s growth in rural Colorado towns outside major metro areas.

Zion’s Tiny Homes

Through Hillcrest Bank, B:Side Fund financed a small-scale modular housing project using sustainable construction models.

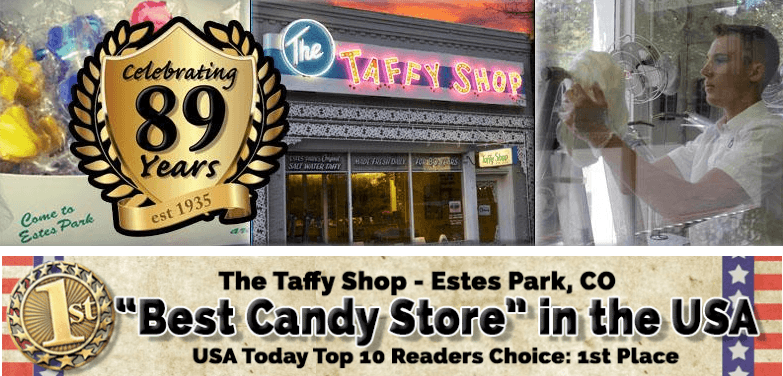

The Taffy Shop

B:Side Fund enabled funding through Bank of Colorado to launch and support a gourmet candy business with local retail presence.

Marie’s Hair & Nail Supply

Bridging Virginia loans helped expand Marie’s beauty supply store, doubling inventory and supporting micro‑entrepreneur vendors.

Owl Spoon Water Kefir

A loan via Bridging Virginia allowed Owl Spoon to scale from home‑scale batches to 250‑gallon production capacity.

The Graeff‑Byrnes Family

Jenna and Matthew used Tenfold’s homebuyer education to become homeowners in Lancaster’s SoWe neighborhood, reducing financial barriers.

Pickleball Mania

AE financing helped Lesa Carter expand her community recreation business, offering events like family nights for 75+ attendees.

The Juice Collective

AE helped LaTeka Cooke-Davis start her juice bar when others wouldn’t; she’s expanding from Horseheads to downtown Elmira.

NuLife Kicks

ACCESS Community Capital Fund supported NuLife Kicks, a shoe repair business

Success Story: Kenesha

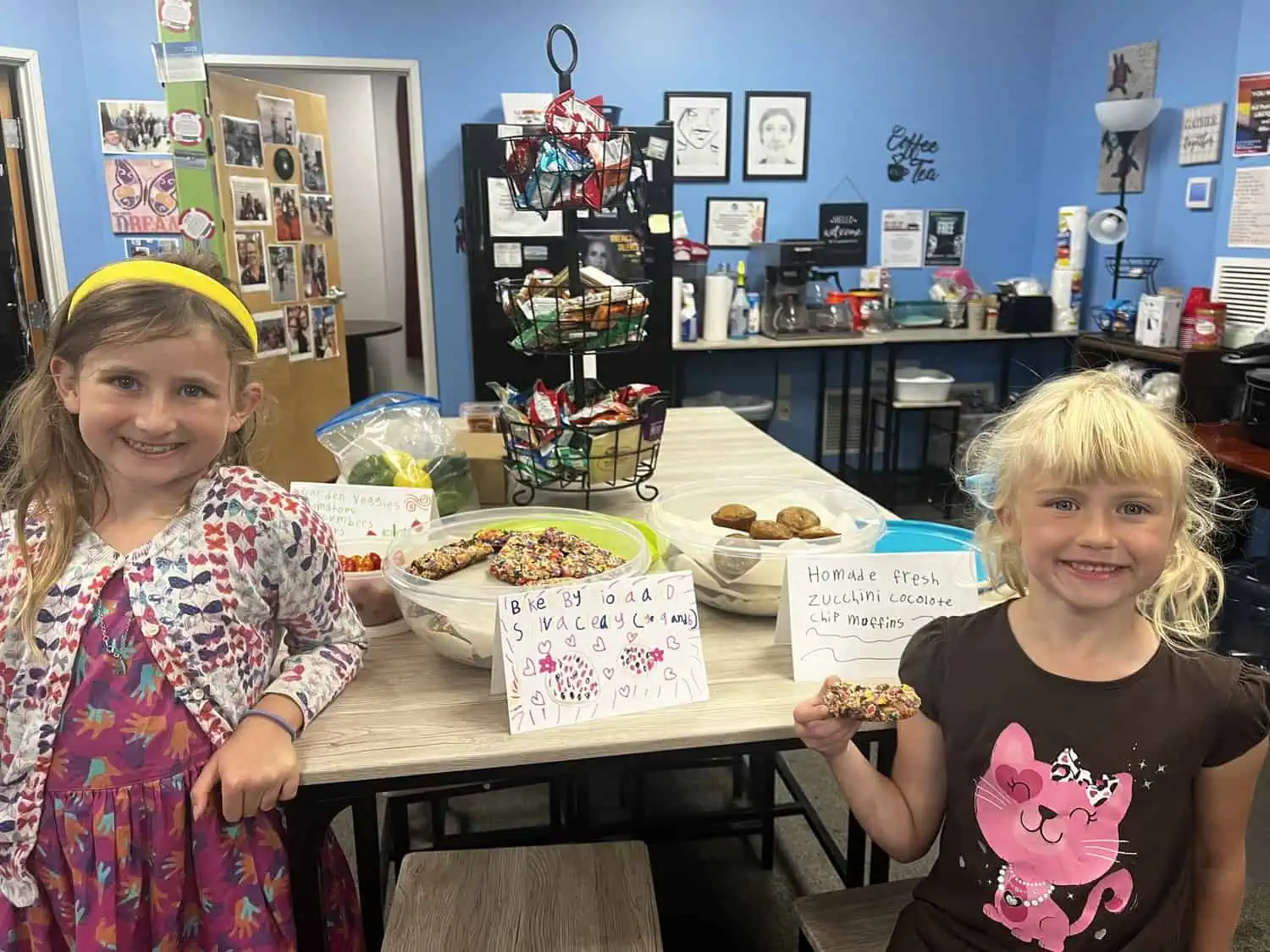

A small loan from ACCESS Community Capital Fund enabled Kenesha to turn a sweet idea into a business.

Spark’s Mission is to Dramatically Transform Disinvested Neighborhoods

Spark positively impacts the greater Omaha metropolitan area in many ways. To learn more or to help us achieve our mission – profoundly transforming disinvested neighborhoods into prosperous and thriving communities.

Partners for Financial Freedom

CHWC partnered with CHES to expand credit, budgeting, and homeownership counseling across communities.

Making a Spot for Everyone

CHWC used garden spaces to build connection and belonging among local youth and LGBTQ+ community.

JHTDesign Studios

B:Side Fund provided graphic design business with capital to support expansion, new marketing, and greater client acquisitions.

Rosenberg’s Bagels and Delicatessen

B:Side Fund help First National Bank finance this bagel shop’s growth and job creation in its local neighborhood.

Land Ark RV, LLC.

B:Side Fund backed this mobile RV outfitter’s expansion with a Zions Bancorporation-supported loan package.

Rasta Salsa

B:Side Fund supported loan structuring via Encore Bank to launch this salsa brand and build distribution capacity.

Lift Chocolate

B:Side Fund enabled financing via FirstBank for this social enterprise chocolatier to scale operations and reach broader markets.

Novastar Kids Co (SBA CO Small Business Person of the Year)

B:Side Fund provided NBH Bank with SBA financing support to help this children’s enrichment company scale and earn statewide recognition.

Sierra Mountain Center

When longtime Program Director Emma Gasman seized the opportunity to purchase the business, she turned to Access Plus Capital for guidance.

Laumiere Gourmet Fruits

Access Plus Capital funded facility expansion and equipment upgrades to scale a dried‑fruit snack business.

OZ‑Invested Industrial Development

OPAL helped structure Opportunity Zone investment via OPAL Fund into REAL Park, bringing industrial jobs and investment to Tuskegee area.

Rural Grocery Store Revitalization

OPAL’s CGA program recruited new owner and introduced two CDFIs to upgrade equipment and facades of Market Place in Livingston.

Edgewood Outfitters

Capital from Bridging Virginia helped start a size-inclusive boutique supporting women in Newport News