The CDFI Coalition, representing the nation’s Community Development Financial Institutions (CDFIs), held its 2020 Annual CDFI Institute on February 27 and 28 in Washington, D.C. This year’s event drew one of the event’s largest audiences, with nearly 200 people attending over the two days. Members of Congress, congressional staff, federal agency officials and key staff, as well as experts from the CDFI community spoke and participated in panels on policy and resources related to the work of CDFIs.

It was a packed agenda. Highlights of the event included keynotes from Comptroller of the Currency Joseph Otting, CDFI Fund Director Jodie Harris, and Representatives Carolyn Maloney; Mike Quigley, House Financial Services and General Government Appropriations Subcommittee Chairman; and Gregory Meeks, Chairman of the House Financial Services Subcommittee on Consumer Protections & Financial Institution. Attendees also heard keynote remarks from CDFI Coalition supporters, including En Jung Kim of Chase and Joel Wittenberg of W.K. Kellogg Foundation.

CDFI Coalition Board Member Ceyl Prinster of Colorado Enterprise Fund Introduces Comptroller Otting.

CDFI Fund Director Jodie Harris speaks about the Fund’s priorities and plans for 2020.

Chairman of FSGG Appropriations Subcommittee Mike Quigley spoke to attendees during a morning keynote on Feb. 28th.

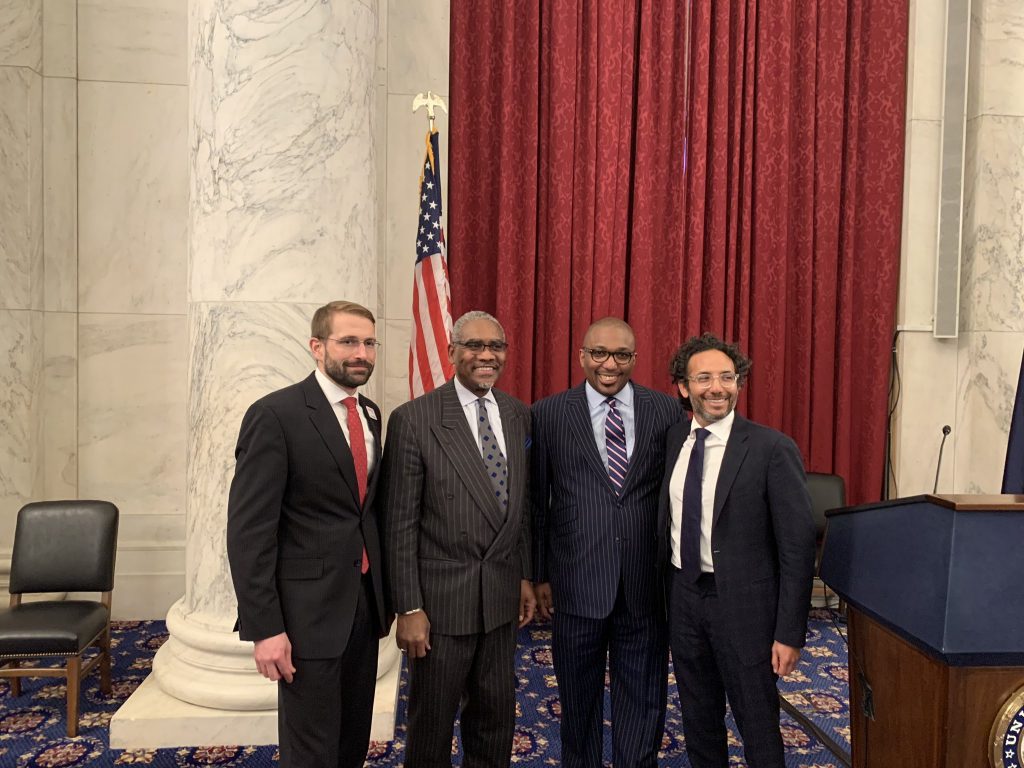

CDFIC Chair Dom Mjartan, Rep. Gregory Meeks, CDFIC Vice Chair John Holdsclaw, and James Gutierrez of Aura at the Coalition’s reception, following the Congressman’s remarks.

CDFI champion Rep. Carolyn Maloney addresses attendees at the Coalition’s Capitol Hill reception.

Gold Sponsor of the CDFI Coalition 2020 Institute En Jung Kim of Chase provides remarks about her institution’s work with CDFIs and introduces CDFI Fund Director Jodie Harris.

CDFIC Board Member Teresa Montoya of GECU introdcuces panel of federal agency speakers from HHS, SBA, FHFA, and USDA.

2020 CDFI Coalition Institute Partner Joel Wittenberg of the W.K. Kellogg Foundation provides keynote remarks during the breakfast plenary on the importance of diversity and inclusion.

There were ten panel discussions focused on timely matters impacting the CDFI community, including a discussion on recently proposed changes to the Community Reinvestment Act from the OCC and FDIC, Legislative Priorities in Congress for 2020, as well as a session with key Treasury Department staff. Attendees also had the opportunity to engage with federal agencies beyond Treasury during a panel titled, Federal Resources for CDFIs. Rafael Elizalde, Program Manager with the Office of Community Services at U.S. Department of Health and Human Services (HHS); Bill Manger, Associate Administrator for the Office of Capital Access at U.S. Small Business Administration; Ethan Handelman, Senior Policy Analyst at Federal Housing Finance Agency; and Mark Brodziski, the Deputy Administrator of Business Programs for the Rural Business-Cooperative Service at the U.S. Department of Agriculture all provided updates on programs used by many CDFIs to serve a variety of business, housing, and community development needs in communities nationwide.

Building on conversations during past CDFI Coalition Institutes on addressing unconscious bias and diversity within the CDFI Field, a session focused on how well CDFIs are meeting racial and social equity objectives encouraged discussion among attendees on ways to better evaluate impact. The audience heard from two CDFIs, including Carla Mannings of Partners for the Common Good and Olivia Renabal of Capital Impact Partners, and impact investor Cynthia Muller from the W.K. Kellogg Foundation. The panel reflected on earlier keynote remarks made by Joel Wittenberg, who called on organization leaders and managers to ask themselves about who’s in the room and who’s not? Panelists noted that by including communities and people of color, we will get more ideas and better solutions. Moderator John Holdsclaw noted that CDFIs should remember that while diversity is a reality, inclusion is a choice.

CDFIC Vice Chair John Holdsclaw of NCB moderates panel on meeting racial and social equity objectives in the CDFI community. Panelists included Carla Mannings of Partners for the Common Good, Olivia Renabal of Capital Impact Partners, and Cynthia Muller of W.K. Kellogg Foundation.

Discussion on OCC and FDIC CRA proposals with community development experts, including moderator and Board Member Cathie Mahon of Inclusiv, as well as Gerron Levi of NCRC, Dafina Williams of OFN, and Alison Hickman of CohnReznick.

Another popular session topic centered on how CDFIs can help build resiliency and address the disproportionate impact of climate change in low-income and communities of color. Panelists were comprised of CDFIs and investors, including Keith Bisson of Coastal Enterprises, Inc. (CEI), Erin Kilmer Neel of Beneficial State Foundation, Brenda Loya of Amalgamated Bank, and Steve Saltzman of Charleston LDC. They discussed opportunities such as creative investments for businesses impacted by climate change, investing in a clean energy future in an equitable way, and addressing affordable housing policies exacerbating the impact of disasters.

The Coalition also held three concurrent sessions featuring CDFI and agency experts and impact investors from leading foundations. The panels included one highlighting innovative structuring of off balance sheet funds that explored the different roles and impact investment vehicles necessary to allow investor confidence; a session on homeownership and the availability of affordable housing, which looked at policy proposals and current program initiatives underway; as well as a discussion on the challenges and opportunities in financing healthcare projects that support the delivery of integrated services in underserved rural and urban communities.

The agenda was rounded out by insight offered by banks partnering and investing in CDFIs. Panelists from Bank of America, BBVA Compass, US Bank, JPMorgan Chase, and Wells Fargo provided information on their current priorities and current issues their institutions are considering when making investments into distressed communities through CDFIs.

The Coalition’s Annual Business Meeting was also held in conjunction with the Institute. Six candidates were elected to open Board seats, including Marten Jenkins of Natural Capital Investment Fund (at-large seat), Rachelle Arizmendi of Pacific Asian Consortium Employment (at-large seat), Erin Kilmer Neel of Beneficial State Foundation (bank seat) Teresa Montoya of GECU (credit union seat), Ceyl Prinster of Colorado Enterprise Fund (micro loan fund seat), and Saurabh Narain of National Community Investment Fund (intermediary seat). In addition, the Coalition thanked its current Board Chairman Dominik Mjartan of Optus Bank for his service from March 2018-February 2020, and welcomed incoming Chairman John Holdsclaw IV of National Cooperative Bank.

As in the past, the Institute offered time to for attendees to cultivate relationships with fellow community development professionals. However, most importantly, it was a great opportunity for CDFIs and partners to share real-time information on important policy and industry matters, promoting substantive discussions, reflection on industry practices and strategies for the future.

Materials and resources from the Institute can be found on the events page and more photos are posted on the Coalition’s Facebook page and Twitter.