CDFIs: On the Front Lines of Disaster Recovery Efforts

Community Development Financial Institutions (CDFIs) are uniquely positioned to meet the lending needs of recovering communities. Disasters hit vulnerable communities the hardest, and many CDFIs have decades of experience providing economically disadvantaged individuals with the tools they need to become self-sufficient stakeholders in their own future.

CDFIs have access to tools that are able to effectively rebuild dis-invested communities and make loans to individuals with limited or poor credit histories -requiring more than simply providing access to conventional loans. The flexibility to adapt lending guidelines to the needs of borrowers is possible: allowing for acceptance of unconventional collateral for loans; to help small businesses navigate government red tape; and to provide education, training, and assistance to potential borrowers.

- Providing Financial Services, Loans & investments

- Offering Training & Technical Assistance

- Promoting Development, Enabling Individuals & Communities to Effectively Use Credit & Capital

In the wake of a natural disaster, Americans mobilize billions of dollars in relief through foundations, individuals, and the public sector. While those resources go toward the rebuilding of infrastructure, individual assistance, and the meeting of immediate needs, they also support more complicated medium and long-term efforts to rebuild and repair housing, replace damaged building stock, and jump-start economic activity.

FEMA can handle much of the short-term emergency assistance, but long after federal government is gone, mission-driven lenders – particularly those with long-standing ties to affected communities – will be on the ground working to restore housing stock, rebuild community facilities, and provide technical assistance and financial assistance to businesses and families.

As Congress debates additional federal assistance for communities devastated by natural disasters, they should consider the track record of CDFIs that have the infrastructure and relationships in place to offer immediate and prolonged help throughout recovery efforts.

Natural disasters destroy and damage businesses’ physical assets like buildings, furniture, and equipment. They also wipe out hospitals, schools, and essential community facilities. As lenders, CDFIs have a long track record of providing flexible financial products that are well-suited for the post-disaster environment. Annually, CDFIs provide over $3 billion in loans and investments to over 11,000 small businesses for everything from equipment to working capital to new facilities.

Affected communities can benefit greatly from economic assessment, technical assistance, and capacity building. Specifically, analytical capacity and assistance with navigating federal and state programs and non‐governmental resources can help recovering communities. CDFIs can help businesses navigate red tape and get up and running again.

Before economic recovery efforts can truly proceed after a disaster, people need to be able to return to new or rebuilt homes. Affordable housing must be replaced or repaired. CDFIs have the capacity to finance thousands of new or repaired homes and affordable housing units. In FY 2016 alone, CDFIs financed nearly 33,000 affordable housing units and 11,600 home improvement or home purchase loans.

Before economic recovery efforts can truly proceed after a disaster, people need to be able to return to new or rebuilt homes. Affordable housing must be replaced or repaired. CDFIs have the capacity to finance thousands of new or repaired homes and affordable housing units. In FY 2016 alone, CDFIs financed nearly 33,000 affordable housing units and 11,600 home improvement or home purchase loans.

PathStone Enterprise Center, Inc., an affiliate of PathStone Corporation is a certified CDFI and serves as an intermediary lender for USDA (IRP) and SBA (Microloan). PathStone utilized $100,000 in CDFI Technical Assistance funds to build capacity in Puerto Rico.

Hurricane Maria, did untold damage to housing, businesses, to community infrastructure and to people. Maria was followed soon afterwards by Hurricane Irma, totally devastating an already weakened island.

In the more remote agricultural mountain and coastal communities served by PathStone the post-storm landscape was dire. 45% of Puerto Rico’s residents live in poverty -the highest of any state or territory- with unemployment more than twice the US level. Unemployment in the mountain communities can reach as high as up to 60% of the population outside San Juan, Mayaguez, Ponce and Arecibo. Many of the region’s structures, residential and commercial alike, were either seriously damaged or completely destroyed. The Puerto Rico Power Authority damage was so extensive, more remote regions of the Island did not have power for months. The communications infrastructure was almost completely destroyed. 90% of the cell towers were destroyed.

After Sandy, the CDFI Fund conducted an assessment of CDFI performance during the storm and found that despite experiencing the damage as flood waters reached their buildings, CDFIs once again demonstrated how their flexibility and adaptability make them an important partner in times of crisis. Ten CDFIs had some damage to their offices, i.e., no electricity, heat, phone, Internet, etc. One respondent, Enterprise Community Partners, sustained serious damage and flooding in its New York office.

Below are a few of the initiatives reported in the CDFI Fund assessment:

- ACCION established a small business loan fund for businesses impacted by the storm.

- Business Outreach Center Capital launched a disaster recovery loan program for any small business that was physically and/or financially impacted by the storm throughout the five boroughs of New York City.

- Empire State Development Corporation (in partnership with the Governor’s office) launched a number of assistance programs to address the needs and concerns of the businesses in the areas affected by Superstorm Sandy.

- Enterprise Community Partners launched the Partner Support and Rebuilding Fund (Fund) to provide financial assistance to help its affordable housing partners with immediate recovery and rebuilding efforts.

- Low Income Investment Fund committed $1 million (as of November 2012) to ensure that those hardest hit by the storm have access to food and much needed services.

- Primary Care Development Corporation and the Community Health Care Association of New York City (CHCANYS) co-directed the Primary Care Emergency Preparedness Network (PCEPN), a New York City Department of Health and Mental Hygiene initiative to provide primary care representation at the New York City Emergency Operations Center (EOC). Before, during, and after the storm, PCEPN enabled a core group of approximately 27 primary care networks representing over 90 primary care locations throughout New York City to stay updated about storm situations, resources, and recovery efforts.

- Seedco Financial Services (now TruFund) developed a Small Business Recovery Initiative geared toward addressing a targeted set of disaster recovery related needs for small businesses that suffered from storm-related impact.

New Jersey Community Capital’s REBUILD Fund

In 2012, New Jersey Community Capital (NJCC), with seed funds from Goldman Sachs Gives and other key investors, launched the REBUILD New Jersey loan fund to aid recovery for small businesses in areas most severely impacted by Hurricane Sandy. NJCC has contributed $750,000 in lending capital to REBUILD and immediately began offering low-interest loans to small business owners in order to continue to fulfill its longstanding mission of stabilizing communities in need. The loans were made in Jersey City, Newark, and Asbury Park.

Through May 2013, NJCC’s lending staff had already provided New Jersey small businesses with 23 loans totaling $574,000, creating or preserving over 135 jobs. NJCC also expanded its recovery effort by integrating its proven housing and neighborhood stabilization strategies in Sandy-affected areas, another process that requires a long-term commitment of capital and planning.

In March 2013, NJCC closed its first REBUILD housing loan to support a local partner, the Affordable Housing Alliance, in building 17 new manufactured homes in Eatontown, NJ for families displaced by the storm.

NJCC REBUILD Fund Stories

Grove Street Bicycles, Jersey City

Grove Street Bicycles, a go-to shop for a wide range of Jersey City’s local bicycle commuters and hobbyists, was hit hard by Hurricane Sandy: it lost power for five days, and heavy flooding damaged its basement walls and destroyed tools and inventory. NJCC was the first to respond with recovery funds, providing a low-interest $30,000 REBUILD loan to help the store cover repairs and inventory replacement. It was fully operational before long and is already growing.

Cowerks, Ashbury Park

Cowerks was founded in 2010 as a flexible shared office space and networking hub for Asbury Park-area technology freelancers and startups. When Cowerks outgrew its office, it found a new space in Asbury Park’s downtown, but after Hurricane Sandy forced the company to close its doors for 10 days, it was compelled to redirect its moving funds to its operations. NJCC’s REBUILD New Jersey fund provided Cowerks the working capital it needed to reopen in its new location just months after the storm.

- REBUILD Fund announcement

- Governor and White House honor REBUILD

- N.J. nonprofit lender buys hundreds of troubled mortgages in 9 counties hard hit by Sandy

LIIF Commits $1 Million to Communities Affected by Sandy

Shortly after Sandy made landfall in New Jersey, the Low Income Investment Fund (LIIF) committed $1 million to relief for communities ravaged by the hybrid storm.

Shortly after Sandy made landfall in New Jersey, the Low Income Investment Fund (LIIF) committed $1 million to relief for communities ravaged by the hybrid storm.

Among the first projects that LIIF supported was St. John’s Bread & Life, an emergency food provider that used its mobile soup kitchen in the immediate aftermath of the storm to deliver thousands of meals and supplies to affected areas.

Gulf Coast Renaissance Corporation Created to Aid Mississippi

Hurricane Katrina washed ashore in South Mississippi in August 2005. In the devastating storm’s wake lay some of the greatest structural devastation from a natural disaster that has ever incurred in the country’s history. But amid the flooded ruins, hope found a way to float through the vision of several South Mississippi community and business leaders, organized as The Gulf Coast Business Council. The nonprofit group had the foresight to understand the key to the area’s recovery would be a unified effort focused on redevelopment.

Hurricane Katrina washed ashore in South Mississippi in August 2005. In the devastating storm’s wake lay some of the greatest structural devastation from a natural disaster that has ever incurred in the country’s history. But amid the flooded ruins, hope found a way to float through the vision of several South Mississippi community and business leaders, organized as The Gulf Coast Business Council. The nonprofit group had the foresight to understand the key to the area’s recovery would be a unified effort focused on redevelopment.

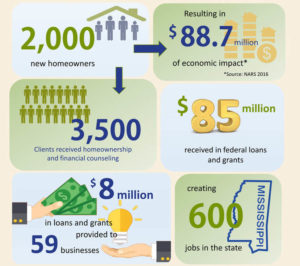

In mid 2006, the council created Gulf Coast Renaissance Corporation, a CDFI, to help rebuild the Mississippi Gulf Coast by bridging the gap in the need for safe and affordable workforce housing. Since then, Renaissance has helped make distinct improvements to the communities by promoting community and economic development through various programs implemented to deliver effective and meaningful results.

Calvert Foundation Gulf Coast Recovery Initiative

Just fifteen months after Katrina, the Calvert Foundation had already directed a total of $1.6 million in affordable loan capital to the Gulf Coast Region. These loans were based, in part, on investment funds raised since 2005 through its “Gulf Coast Recovery Initiative.”

Calvert disbursed $1 million to the Community Recovery Fund, partnering with Rural Local Initiatives Support Corporation and Enterprise Community Partners to provide permanent affordable housing to working poor and extremely low-income people primarily in Louisiana, Mississippi and Alabama. Enterprise Housing provided emergency housing and support services to 1,500 Hurricane Katrina evacuees and advised the Louisiana Recovery Authority on developing a comprehensive $8 billion housing rebuilding plan. An affiliate of the Local Initiatives Support Corporation committed a total of $50 million for first mortgage loan capital to support over 1,000 affordable housing units in Louisiana and Mississippi by late 2016.

The GO Zone Act of 2005 Expands the New Markets Tax Credit into Gulf Opportunity Zones

Hurricane Katrina devastated many New Orleans, Alabama, and Mississippi communities that were already reeling from decades of poverty, unemployment, and economic stagnation. In the wake of Katrina, Congress passed The Gulf Opportunity Zone (GO Zone) Act of 2005, P.L. 109-135, which provided tax relief to The GO Zone, comprised of those counties or parishes that were deemed eligible by FEMA for “individual assistance” or “individual and public” assistance in after the storm.

The GO ZONE encompasses 91 counties or parishes, including: eleven counties in Alabama; 31 parishes in Louisiana; and 49 counties in Mississippi. In light of both the devastation of Katrina and the extensive poverty that pre-dated the storm, the legislation included a temporary $1 billion expansion of the federal government’s largest community revitalization initiative: the New Markets Tax Credit.

NMTC allocation was awarded to CDEs and CDFIs targeting the GOZONE in 2 competitive rounds: 2006 and 2007, generating an estimated $2 billion total economic activity and 23,000 jobs in high poverty disaster affected areas of the gulf coast.

Instead of reinventing the wheel and providing billions to new or untested programs, Congress enacted an expansion of the New Markets Tax Credit, providing resources to an existing network of community development organizations with deep ties to the GOZONE region and the ability to deploy capital quickly to businesses, community facilities, and economic revitalization projects in low income areas. While the emergency allocation was only temporary, the work continues today in the GO ZONE as CDFIs continue to target investment to some of the hardest hit areas of the Gulf Coast.